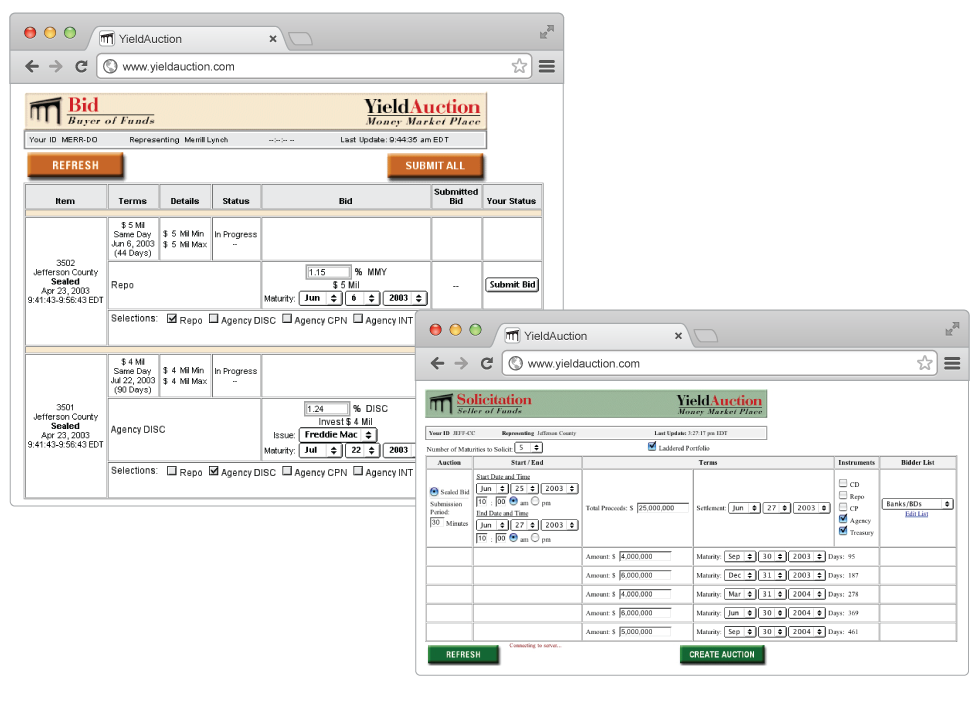

Simplify Solicitations for Open Market Securities/Money Market Instruments

Benefits of YieldAuction™

- A few minutes online can save hours a day

- After terms are identified, banks and broker/dealers receive instant electronic notification of solicitation

- Real-time environment encourages banks and broker/dealers to submit their most competitive rates

- Bidding information is captured in one place in a matter of minutes

YieldAuction allows public entities to solicit bids for open market securities and money market instruments from their approved list of banks and broker dealers.

Bids can be solicited for any one or any combination of instruments including:

- CDs

- Repos

- Commercial Paper

- U.S. Treasury and Agency Securities

- Laddered portfolios for Refunding Escrows

- Construction funds

Bids can be solicited on an all-or-none (AON) or maturity-by-maturity (MBM) basis for CDs, Repos, CP, Treasuries, and Agencies.